Imagine sailing the vast financial seas, armed with only a compass and the mysterious map of Nemo Money. Can this platform guide you safely through the waves, or are there storms lurking beneath its surface? Beginning with what it offers and how it positions itself against unforeseen financial currents, this review navigates through the treasures and trials of Nemo Money.

Exploring the Wealth of Services Offered by Nemo Money

Have you ever wished for a single platform to manage all your financial needs? I know I have. Enter Nemo Money, a platform that positions itself as a comprehensive financial hub. But does it truly deliver on its promise? Let's dive in.

The Range of Services

One of the most striking aspects of Nemo Money is the sheer breadth of services it seemingly offers. Unlike platforms focused on a single area like investing or budgeting, Nemo Money appears to be a hub connecting users with solutions for:

Loans & Financial Services: This could encompass personal loans, mortgages, and other credit facilities.

Credit Cards: Offering comparisons or access to various credit card options.

Reporting & Repair: Potentially assisting with credit score monitoring and repair services.

Tax: Providing resources or connections to tax preparation services.

Real Estate: Perhaps offering tools or connections for property-related financial aspects.

Insurance: Possibly providing quotes or access to different insurance providers.

Legal: Potentially connecting users with legal resources for financial matters.

It's like having a financial Swiss Army knife at your fingertips. But, is it sharp enough in each area?

The Appeal of a 'One-Stop-Shop'

In today's fast-paced world, the appeal of a single platform managing diverse financial needs is undeniable. Who wouldn't want to save time and effort by accessing multiple financial resources through one portal? It's like having all your favorite apps rolled into one. But, as with any jack-of-all-trades, there's a lingering question: does Nemo Money master any?

Nemo Money positions itself as a comprehensive financial hub.

While this "one-stop-shop" approach can be appealing, it raises questions about the depth and expertise within each specific service area. Can Nemo Money truly provide the same level of expertise as specialized providers?

Questions About Expertise

Let's be honest. It's challenging for a single platform to be an absolute expert in every area of finance. Users might find more specialized and in-depth services elsewhere. For instance, while Nemo Money offers tools for taxes, real estate, and legal matters, does it provide the depth needed for complex financial decisions? Or is it more of a gateway to other services?

Moreover, with such a broad spectrum of services, how does Nemo Money ensure quality and reliability across the board? Are there hidden currents we should be aware of?

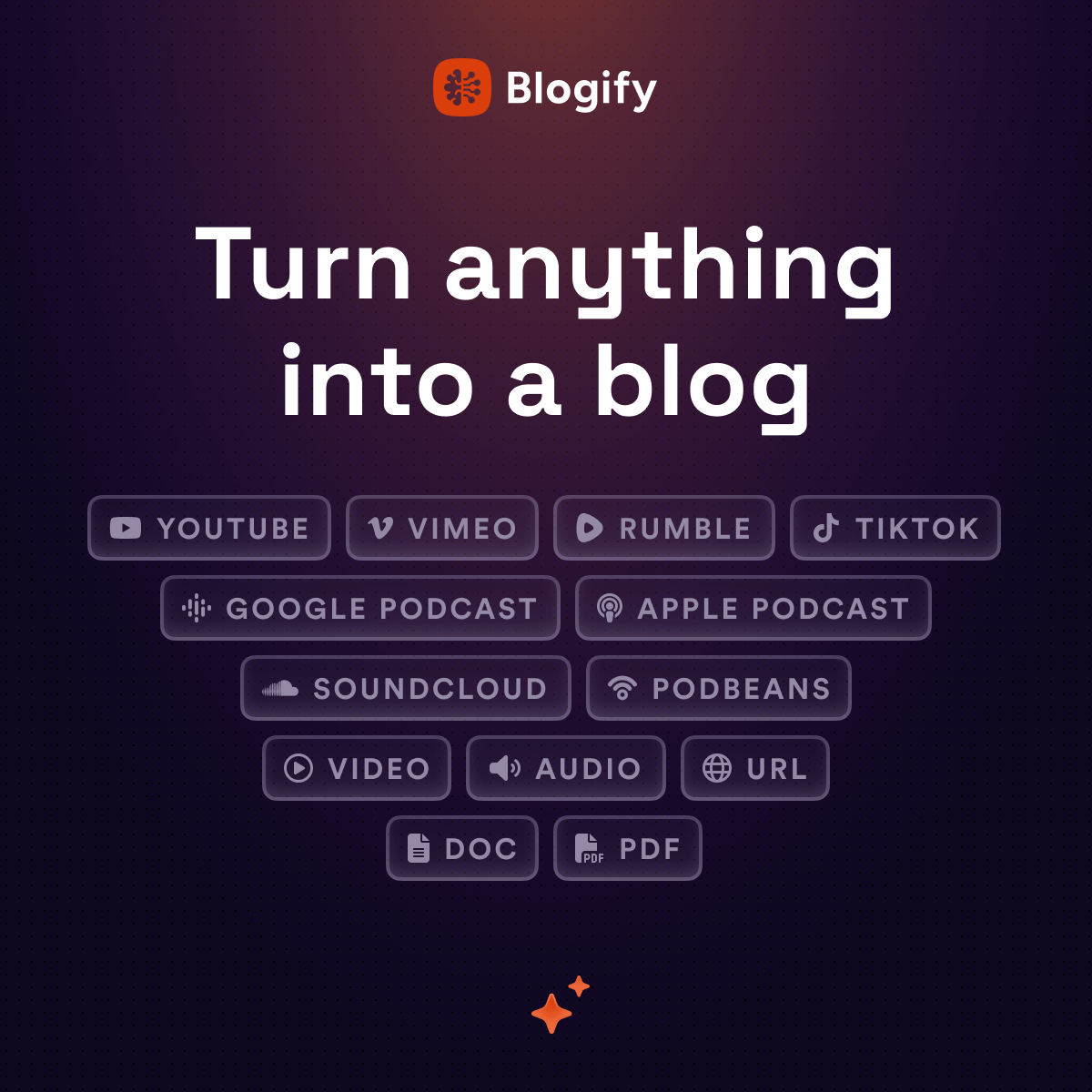

Visualizing Nemo Money's Services

To better understand the range of services offered by Nemo Money, let's visualize it. Below is a mind map showcasing its claim as a 'one-stop-shop' for financial management:

Nemo MoneyLoans & Financial ServicesCredit CardsReporting & RepairTaxReal EstateInsuranceLegal

As you can see, Nemo Money covers a wide array of financial services. But, as with any tool, it's essential to understand its capabilities and limitations. Are you ready to explore Nemo Money's offerings? Or do you prefer specialized platforms for each financial need?

Navigating Transparency and Trust in Financial Services

In the world of financial services, trust and transparency are not just buzzwords. They're the bedrock of any successful financial platform. As someone who's always on the lookout for reliable financial tools, I recently stumbled upon Nemo Money. It's a platform that promises to be a one-stop-shop for all your financial needs. But, as with any service, it's crucial to dig deeper. Are they truly transparent? Can we trust them with our sensitive data? Let's explore.

Transparency in Fees and Service Operations

First things first: fees. Nobody likes hidden charges. It's like ordering a meal and finding out there's an extra charge for the plate. Nemo Money, like any financial service, must clearly disclose its fees. How do they make money? Is it through commissions, subscription fees, or something else? These are questions that need answers.

It's essential to understand how platforms earn revenue and secure your data. This quote resonates with me. Knowing how a platform earns its keep can reveal a lot about its priorities. If fees aren't clearly laid out, it can lead to mistrust. And trust, once lost, is hard to regain.

Potential Bias Due to Partnerships

Now, let's talk about partnerships. Nemo Money offers a wide range of services, from loans to legal assistance. But how do they manage to offer such a variety? The answer likely lies in partnerships with other financial institutions. While this can be beneficial, it also raises questions.

Are the recommendations unbiased?

Do they prioritize partners who pay them more?

These are valid concerns. Partnerships can sometimes skew the options presented to users. It's like going to a restaurant and being recommended dishes that the chef wants to sell, not necessarily the best ones. As users, we need to be aware of this potential bias.

Security and Data Privacy

Finally, let's address the elephant in the room: data privacy. In today's digital age, our financial data is more vulnerable than ever. Entrusting a platform with this information requires robust security measures. So, what does Nemo Money do to protect our data?

What security protocols are in place?

How is our information used and shared?

These are critical questions. Without clear answers, users might hesitate to share their data. After all, it's not just about money; it's about peace of mind.

Key Considerations

As we navigate the financial seas with platforms like Nemo Money, there are a few key considerations to keep in mind:

Transparency in Fees: Always know what you're paying for.

Partnerships: Understand who the platform is working with and why.

Data Privacy: Ensure your data is protected.

Here's a quick overview of these considerations:

Aspect | Details |

|---|---|

Transparency in Fees | Clear disclosure of how the platform earns revenue. |

Partnerships with Financial Institutions | Potential bias in recommendations due to partnerships. |

Security and Data Privacy | Robust security measures to protect user data. |

In conclusion, while platforms like Nemo Money offer convenience, it's vital to approach them with a discerning eye. Transparency, trust, and security should always be at the forefront of our decision-making process. After all, it's not just about managing our finances; it's about safeguarding our future.

Assessing the Overall Experience: User Interface and Support

When I first stumbled upon Nemo Money, I was intrigued. The platform promises to be a comprehensive solution for a myriad of financial needs. But, as with any digital service, the devil is in the details. How does Nemo Money fare in terms of user interface and support? Let's dive in.

User Interface Design and Ease of Navigation

First impressions matter, especially in the digital world. Nemo Money's website is undeniably modern and clean. It's like walking into a well-organized library. But, as we all know, looks aren't everything. The real test is how easy it is to find what you're looking for.

Imagine you're in a massive library. Everything is neatly arranged, but you can't find the book you need. Frustrating, right? That's the challenge some users might face with Nemo Money. The platform offers a broad spectrum of services, from loans to legal assistance. While this variety is commendable, it can also be overwhelming. Users seeking simplicity might find themselves lost in a sea of options.

However, once you get the hang of it, navigating Nemo Money becomes second nature. The key is to take your time and explore. But, in today's fast-paced world, not everyone has the luxury of time.

The Importance of Reliable Customer Support

Now, let's talk about support. In the realm of financial services, reliable customer support is not just a nice-to-have; it's a necessity. As the saying goes,

"Reliable customer support is a cornerstone of effective financial service platforms."

Nemo Money seems to understand this.

The platform offers multiple channels for support: email, phone, and chat. But here's the catch: multiple channels don't always equate to quality. It's like having several doors to a house, but only one leads to the living room. Users have raised questions about response times and the quality of assistance provided. Is Nemo Money's support team as responsive and helpful as they claim? That's something only time and user feedback can truly answer.

Challenges with Potential Information Overload

With great variety comes great responsibility. Nemo Money offers a plethora of services, which is both a blessing and a curse. On one hand, it's convenient to have everything in one place. On the other, it can lead to information overload.

Think of it like a buffet. There's everything you could possibly want, but where do you start? For users who prefer simplicity, this can be daunting. The challenge lies in balancing the breadth of services with user-friendliness. Nemo Money needs to ensure that users aren't overwhelmed by the sheer volume of information.

So, what's the verdict? Nemo Money is a promising platform with a lot to offer. Its modern design and range of services are impressive. But, as with any tool, it's essential to understand its nuances. The user interface, while clean, requires some getting used to. And while the support channels are there, their effectiveness is still up for debate.

In conclusion, Nemo Money is like a vast ocean. It's beautiful and full of potential, but navigating it requires skill and patience. If you're considering diving in, take your time to explore. Understand the platform's offerings, and don't hesitate to reach out for support if needed. After all, in the world of finance, informed decisions are the best decisions.

Have you tried Nemo Money? What was your experience like? I'd love to hear your thoughts in the comments below!